Market research surveys are a quick way to collect feedback from your target audience, helping to inform your business decisions. Surveys offer actionable insights into market trends and how your customers (or potential customers) view your brand or products.

Surveys are a primary research tool because you come up with the questions, set the audience, and compile the results. Secondary market research includes methods like buying industry survey reports on market size and volume, or analyzing third-party social media and keyword reports.

The best survey research platforms let you analyze different market segments by demographic, location, industry, product group, or even specific product attributes to get the answers you’re seeking. With surveys, you can collect both quantitative and qualitative data, making your insights more valuable, accurate, and actionable than many other tools.

Best of all, high-quality surveys are easy for your target audience to understand and fast to complete. Let’s take a look at some types of market surveys and best practices for using them.

Key considerations for your market survey

The most effective marketing surveys reach a large number of respondents within a defined target demographic and ask clear, direct questions.

PickFu, a consumer insights platform, has over 15 million panelists across 90 different market segmentations. Whether you’re performing app market research into current trends among college students using the App Store, or brand market research to get an idea of how consumers view your company, you can get reliable responses from real people, fast.

Surveys with a clear purpose deliver the best and most actionable results, so it’s important to choose the right survey type and format for your goals. This includes the types of questions you ask.

Comparison and ranking surveys allow respondents to choose the best options from a given set. Open-ended questions provide additional context and nuance but are sometimes harder to quantify and read.

Top Tip: With PickFu, natural-language processing AI tools sort through the responses to give you a snapshot of common responses and phrases you’ll see. This makes for more efficient qualitative market research. How it Works: Let’s say in a Head-to-Head poll comparing a new lamp design, all your respondents choose option B, but in the optional written feedback field, 60% say they really liked the color of Option A. Your snapshot summary will highlight this finding, and you can then consider adding the color in Option A to the solution in Option B.

Give PickFu a try or read on to learn more about market surveys!

Here are seven survey types you can use for different situations.

Online surveys

Online and email surveys are a fast, effective way to assess a variety of audiences and markets for a wide range of use cases. Successful businesses use these methods to test, validate, and accelerate their sales and marketing efforts – and it can often be done quickly and affordably.

Whether you’re trying to optimize your go-to-market (GTM) campaign, product, app, or something else, conducting market research with online survey tools like PickFu quickly extracts meaningful data from qualified respondents.

Types of surveys you can do to ramp up your marketing research include:

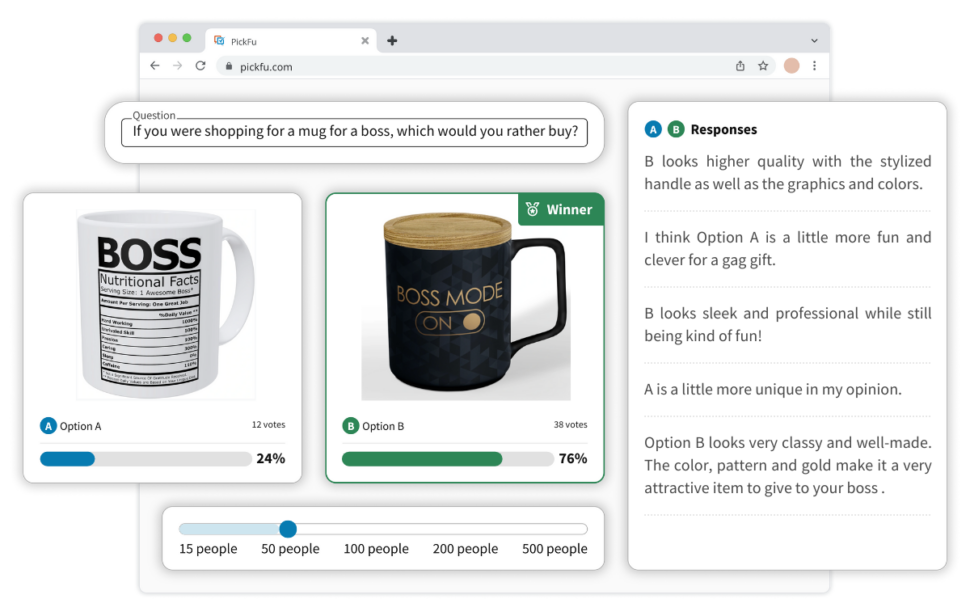

1. Head-to-Head polls

This type of poll is exactly what it sounds like – asking a group of people to compare two options and select the best one. This type of poll works best to break ties, especially late in the product planning or development phase, or break decision paralysis.

You can also add an open-ended “why” question at the end of a Head-to-Head poll to help understand why your consumers chose the option they did.

In this example Head-to-Head poll focused on app development, respondents selected the blue music sheet over the green. The added context showed that the target audience found the blue “easier on the eyes” which demonstrates that ease of use and readability are priorities for these consumers.

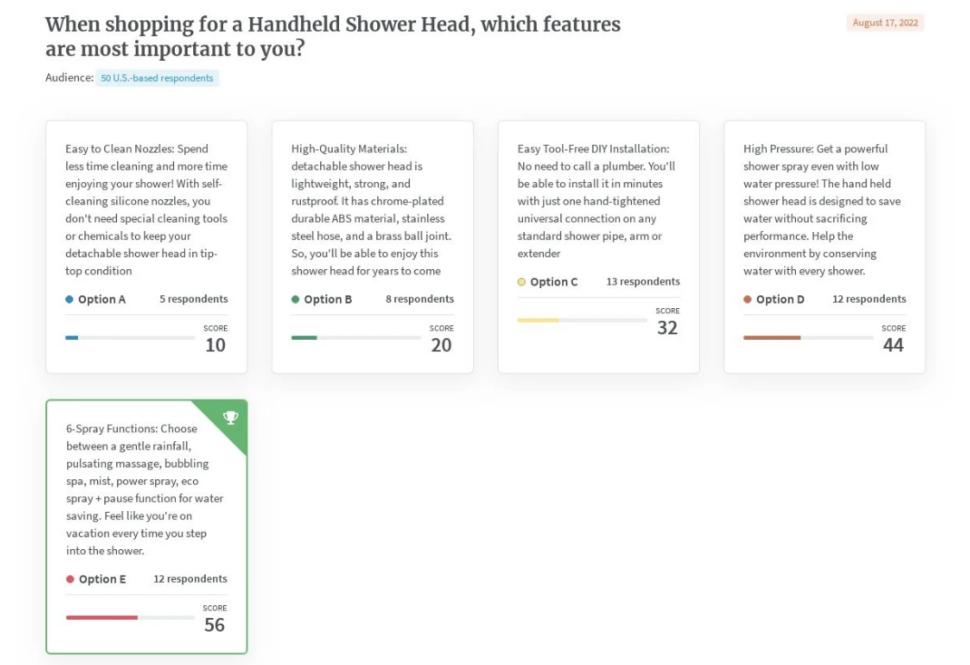

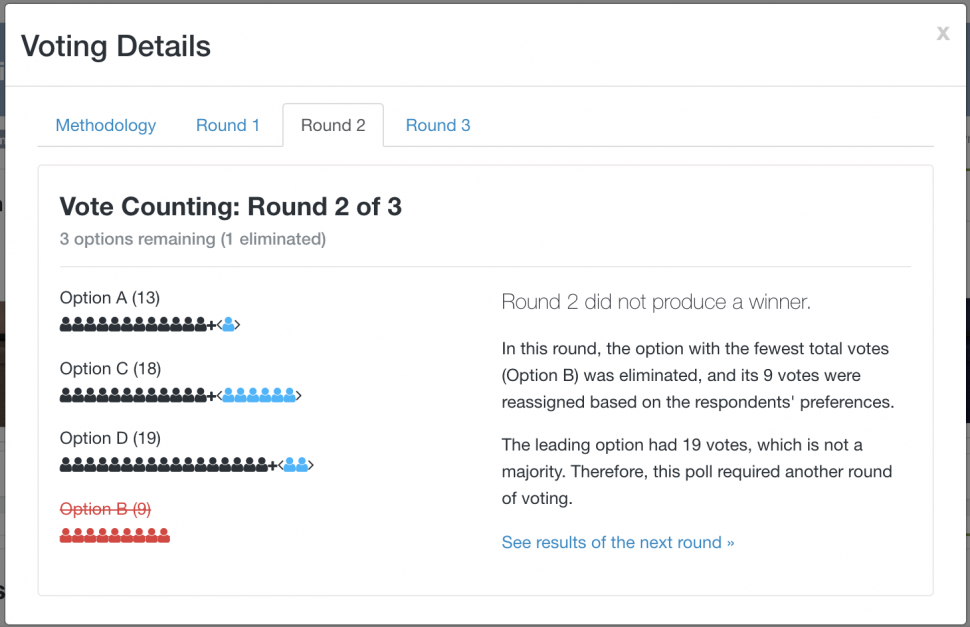

2. Ranked polls

Ranked polls work best for narrowing down multiple options. With PickFu, you can iterate on your concepts and designs by asking panelists to rank three to eight assets in a given poll.

Businesses use Ranked polls in market research surveys to get directional feedback. You can use them to rank things like feature priorities or pricing packages to see which are more appealing. The results are more nuanced than a straight “which one is better” question.

You can also use rankings to compare your products against your competitors and see what customers value from them versus what they like about your offerings.

Design teams like Ranked polls because they help determine which road to go down. In this example of a Ranked poll rating different rug designs, respondents’ feedback gave the designers a clear idea of the themes and colors the audience was most interested in.

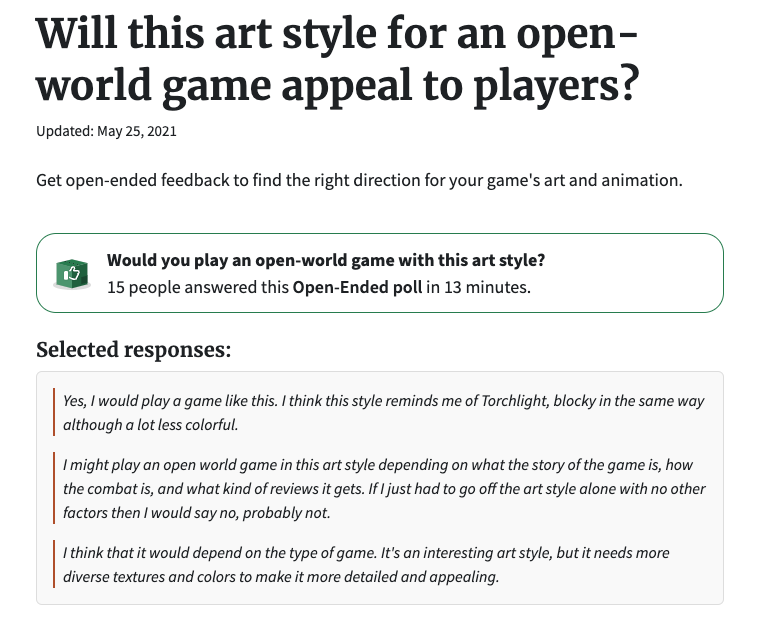

3. Open-Ended polls

Questions that invite feedback from your audience in a less restrictive way are great for early product development and ideation. They can also help you find ways to improve on competitive options in crowded marketplaces.

That’s because open-ended questions can often uncover unexpected ideas or concepts. One great example was this “What do you hate about your shower head” poll.

Respondents gave answers that highlighted their pain points and added real-world context to their product planning efforts. These types of answers allow designers to explore new features and unique selling points for products.

The best open-ended questions for market research are ones that have a clear topic and theme, but don’t promote yes-no-answers.

Open polls can also help you assess brand awareness and the effectiveness of your marketing strategy if you ask for respondents to name brands in a certain field or category.

You also don’t have to make your entire poll open-ended in this way. As we mentioned, you can add an open-ended question on to most polls and invite respondents to add context or detail to their responses.

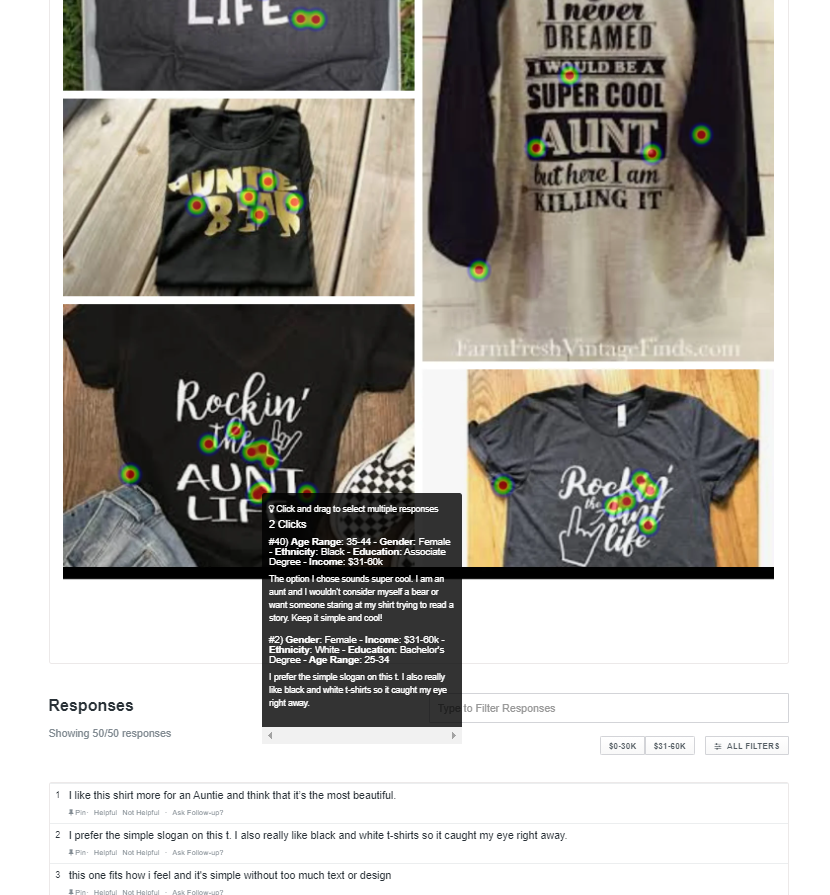

4. Click Tests

You can conduct market research surveys focused on search result pages or marketplaces using PickFu Click Tests. Click Tests ask respondents to interact with the content on the website, clicking up to 10 times on each page. This results in a heatmap that shows which areas the respondents interacted with the most.

Click Tests are particularly good at determining which items on a search result page (SERP) people gravitate toward. They can also show patterns in the kinds of images, designs, or words that capture respondents’ attention.

In this market survey, respondents were asked to click on the image they found most appealing. The heatmap shows that the images with simple and bright colors were the most appealing and that words like “natural deodorant” were the most effective.

This customer feedback on your user experience (UX) can help shape your messaging and optimize advertising creative at the same time.

Other types of surveys

We focused this piece on surveys conducted online or through email because these often provide the fastest, most convenient access to willing respondents. However, there are other types of surveys that aren’t done online, which have their own strengths and weaknesses.

5. Focus groups

Focus groups are a common in-person market research method to gather information and concentrated feedback from your target market. These groups usually give more detailed insight, and you’re able to focus your research questions about new products, marketing campaigns, etc. on specific demographics.

The downside is that the results can be more in-depth, sometimes vague, and difficult to easily interpret and understand. Focus groups can also be costly and time-consuming to put together.

6. Telephone surveys

Telephone surveys are useful for reaching existing customers because they allow you to target specific individuals to get their thoughts and feedback. That’s why you often see telephone surveys used in after-sales support and to collect customer satisfaction scores (CSAT), but less often for product development and pre-launch market testing.

7. Advertising testing

Another type of survey involves A/B testing your ads. This differs from the other survey types because it’s much less intrusive and more passive than asking a group of people direction questions. A/B testing your ads in the field involves using two different ad creative options and tracking how each performs. The results you get helps optimize your ad spend and sales message in the market.

However, this is a reactive approach to surveys and only gives you results after you’ve already entered the market. Head-to-Head polls are an effective way to mimic an A/B test before you launch your ads, helping you save money up front.

Survey tools provide better market research results

Using surveys to reach your potential customer base is a great way to get actionable insights and take your market research to the next level.

You can sign up for PickFu for free to see how polls can help you answer burning business questions in just a few hours or even minutes.

FAQs

What’s the difference between a market survey and market research?

A market survey is just one tool in your market research toolbox, but it’s an important one. People often equate a survey with research, because sometimes it’s the only research they need. A full market research program involves planning, surveys, and customer insights platforms like PickFu to gather intel on the competitive landscape.

Are surveys good for market research?

Market surveys are great anchors for research efforts – they can help distill ideas, highlight opportunities, and test out the theories and plans that you developed as a result of your early market research. Surveys can be inserted at any point in the process, which makes them good for informing decisions before, during, and after your campaigns and launches.

What are the different types of market surveys?

Surveys can be proactive or reactive, qualitative or quantitative, and closed or open. Straight head-to-head polls are more closed, while questionnaires are more open. Surveys can take place in all sorts of mediums, including email, mail, telephone, and online. Question types include: polls, comparisons, head-to-head testing, open-ended questionnaires, and preference rankings, as well as click tests.

What factors can influence market survey results?

All qualitative and quantitative research can be impacted by unexpected factors. Your survey questions themselves, brand loyalty, and your existing market share can all impact the way respondents answer your survey questions. That’s why it’s important to perform multiple, iterative polls on a large demographic to produce reliable product research.