Having trouble finding survey participants? You’re not alone.

The average response rate for online surveys is 44.1%, and simply reaching out to more people doesn’t improve this number.

To add another layer of difficulty, finding participants who match your target audience and provide genuine, in-depth feedback is essential for gathering valuable insights. Meaningful, relevant survey responses lead to accurate conclusions and make your research more credible.

Whether you’re a business owner, marketer, researcher, or just looking to gain personal insights, finding suitable respondents is the key to successful market research.

In this guide, you’ll learn how to easily find high-quality survey participants so you can quickly create, launch, and analyze successful surveys.

Understanding your target audience

Your first step is to understand and define your target audience. If you sell products or provide a service, you should ensure that your survey respondents represent your customers. And researchers need to find participants who align with the specific focus of their study.

This is important because getting accurate data from relevant participants results in more reliable, actionable insights.

Participants typically fall into groups such as:

- General consumers

- Targeted demographics based on age, gender, location, interests, and so on

- Professionals from specific industries, such as academics, students, healthcare professionals, or government employees

When you understand your audience, you’ll drive survey outcomes to better reflect your customers’ needs and perspectives.

For example, one business owner asked coffee lovers which drink they’d prefer as an alternative to coffee.

Most people chose green tea and matcha tea, citing their health benefits. One respondent answered, “Green tea seems to be a really healthy alternative. But energy drinks are never a good choice for regular consumption.”

The business owner learned something important: that health, not just a desire for caffeine, was an important influence on their customers’ choices.

At this stage, you can also define your participant pool, including how many people you need to survey for reliable results.

Learning about your target market and defining key traits early on will help you choose the right survey participants more effectively.

How to find survey participants

As we’ve emphasized already, you need to strategically define your participants’ demographic traits and use targeted methods to boost response rates. As you’ll see, some tools and platforms are more effective than others reaching your specific target audience and encouraging them to engage.

Let’s explore the best ways to find respondents for your research projects.

1. Online survey platforms

Online survey platforms are dedicated tools that cover everything from participant recruitment to survey distribution to data analysis.

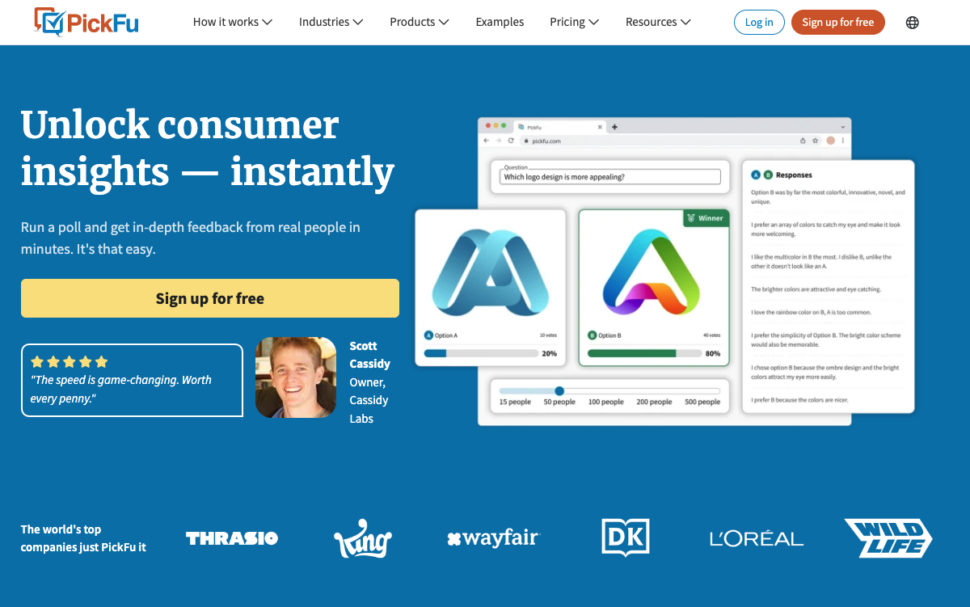

For example, PickFu allows you to build and launch surveys and polls against its built-in panel of real consumers. It has over 15 million vetted respondents from eight countries (and growing). And you can target the participants using 90+ demographic traits to reach your ideal audience.

Let’s look at how you can easily build your survey and find participants with PickFu at the same time.

All you need to do is sign up for PickFu for free.

Next, head to your dashboard and click “Create a survey” in the top right dropdown menu.

You can ask up to eight questions and choose between different question formats, including Open-Ended, Head-to-Head, and more.

We ran a three-part survey asking users about remote work productivity. For this survey, we wanted to reach people in the finance and insurance industries within the U.S.

Our first question asked participants which video conferencing tool they preferred. Most people preferred Zoom over Microsoft Teams for remote work and collaboration.

With every PickFu survey, you’ll get written comments as well as votes – providing you with valuable qualitative information that helps you understand the “why” behind people’s answers. In this example, one user said, “If I had the choice I would prefer Zoom. It’s less resource heavy. Maybe a little easier to use. I might go with Teams if I was using 365.”

For our second question, we asked the panel to rank the most important products for supporting remote productivity.

It’s no huge surprise that high-speed internet mattered the most, but participants’ feedback on hardware, the second most important factor, offered good insights too.

As one user put it, ”You need the proper hardware and monitors first and foremost. That is the most important need, followed closely by high-speed internet. You will fail remotely without those two components. The hardware ensures that you have no lag, and the high-speed internet ensures you have no buffering.”

The third and final question was open-ended, so we could collect unfiltered ideas on using tools to boost remote productivity.

Most respondents shared that video conferencing tools were essential and did the job. However, the open-ended question also uncovered the importance of chat and instant messaging tools. Some people mentioned that higher-quality audio also mattered.

PickFu helps you get diverse perspectives from the right audiences quickly and affordably. Most results come back within a day, depending on complexity, and polls start at just $15.

You can use online survey platforms for:

- Product testing and prototype testing: get feedback from tech enthusiasts or specific demographics on new product ideas, packaging, or features.

- UX testing: receive input on website designs, app interfaces, and user journeys by asking general users to try your app or website. You’ll get user experience feedback from people representing real customers who will interact with your platforms.

- Marketing research: test ad campaigns, your messaging and positioning, logo design, app name ideas, and more with audiences as diverse as moms from Germany or fishing enthusiasts in the US.

- Concept validation: validate a new business idea or product with real people to see if it has potential.

You can collect data for your research study with PickFu or other survey tools like Qualtrics or SurveyMonkey. Choose the right platform based on your research needs, budget, and desired features.

2. Online communities and social media

Online communities can be an excellent resource for finding survey participants who are already engaged in discussions relevant to your study.

These communities typically gather around specific interests or professions and offer a pool of informed respondents who are passionate about the topic at hand.

Check out an example where a game developer asked users on the r/gamedev subreddit about video game preferences.

This developer used a simple Google Forms tool and learned about the audience’s preferred gaming genres, gaming consoles, and other helpful details.

It’s worth noting that getting responses via online communities can be a hit or a miss. If your content and profile are interesting, you could get hundreds of responses but it’s more likely you’ll get minimal engagement.

Responses could come with biases and you’ll find it challenging to guarantee response quality.

But done right, you can gather useful data via questionnaires on community platforms or social media like Reddit, Facebook Groups, Quora, and other places. Here’s how:

- Identify relevant communities: look for online communities, forums, and social media groups that align closely with your research subject. For example, if your niche is women’s fitness, you should target Reddit’s r/xxfitness or Facebook’s Fitness for Women.

- Engage authentically: become an active member of the community before requesting survey participation. Share useful insights, participate in discussions, and build credibility to increase the likelihood of community members responding positively to your survey request.

- Create a compelling pitch: when ready to share your survey, craft a concise and compelling pitch explaining the purpose of your study, why their opinions matter, and how they can contribute. Make sure to highlight any incentives if available.

- Use appropriate channels: each community may have specific guidelines or appropriate channels for posting survey links. Respect these rules by reading the community guidelines and reaching out to moderators if necessary.

- Follow up and share results: after collecting responses, thank the community members for their participation and share some initial findings or results if possible. This shows appreciation and keeps the community engaged – which might help in future research efforts. Using professional networks can also be effective. Tools like LinkedHelper can automate the process of connecting with potential survey participants on LinkedIn, ensuring you reach professionals who match your target demographic.

It’s also possible to leverage important social media features like ads to get good-quality data. For example, B2B research firm ROI Rocket used LinkedIn ads to target dermatologists and aestheticians. The study helped them gather pertinent information about the spa industry by connecting with their relevant target audience.

Finally, use your own social media accounts to share the survey. Encourage your followers to participate and share it with others who fit your target demographic. Posting engaging content or using visual aids like infographics can increase the chances of your survey being noticed and shared.

3. Online forums

Craigslist and niche online forums can also be valuable resources for finding survey participants, especially those passionate about specific topics.

Create a profile on these forums and build compelling and clear posts. When you launch a survey, share the survey’s purpose and any incentives for participation.

Here’s a survey shared on a forum for mountain bike enthusiasts. A mountain bike retail business created a $200 sweepstakes for anyone willing to answer a tire survey.

You can see how the post is clear, short, and offers a tangible benefit for participants. The retailer behind the survey likely gained detailed customer information that would otherwise be hard to find.

Here’s another example where you can see post-survey engagement. A user on the iFish.net fishing and hunting forum shared the results of a survey on waterfowl hunting. This helped hunters learn about regulatory issues while giving the Waterfowl Advisory Group (WAG) in Washington key information.

Share your survey results and findings with the community if you can.

And engage with people regularly to improve future response rates and participation.

4. University mailing lists

University mailing lists are best for academic or specialized studies targeting students or faculty.

A business school might survey its alumni network to gain insights into career outcomes post-graduation. If you want to run surveys on student learning habits, you can email academic departments or student groups to generate highly relevant responses.

Write a formal request to the university’s administration, explaining your study’s objectives and the importance of student participation. Also, communicate with the university’s IT department to access relevant mailing lists and distribute your survey effectively.

Make sure to adhere to any ethical guidelines provided by the institution on student participation and data privacy. Use reputable tools that anonymize personal data when needed and ensure the security of any collected information.

Remember to follow up with a thank you email to all participants and share any significant findings with the university community through appropriate channels such as newsletters, forums, or social media. If you can explain how your survey will further knowledge, this could motivate students to participate enthusiastically.

5. Organizational email lists

Aiming to target professionals in specific fields? Use organizational email lists to pose survey questions to your ideal respondents.

Partner with industry associations or professional bodies to distribute your survey directly through their channels and reach your desired audience efficiently.

For instance, if your survey focuses on trends in cybersecurity, consider collaborating with a cybersecurity organization. This connection will allow you to reach experienced professionals who can provide valuable insights.

Similarly, if you are researching advancements in the engineering sector, surveying members of the American Society of Civil Engineers (ASCE) can yield highly relevant data for your study.

In fact, the ASCE conducts a yearly survey on civil engineers’ salaries to help its members learn more about industry trends and make informed career decisions. You could tap into their pool of engineering professionals and run surveys to get useful information.

Make sure to disclose any compensation or incentives in your recruitment messages – transparency will build trust and encourage participation.

Finally, tailor your survey questions and approach to align with the specific audiences of these organizational lists. You’ll be more likely to get responses.

Conclusion

Hopefully, you now have a variety of strategies and tools in your toolbelt for recruiting survey participants and maintaining response quality.

It’s time to put these strategies into action.

Remember, start by identifying and understanding your target audience, choose the most suitable platforms and channels, and tailor your outreach efforts accordingly.

Better yet, use an all-in-one survey platform like PickFu where you’re guaranteed to find relevant, high-quality participants and get 100% survey completion rates. PickFu survey participants are real, vetted people from a diverse global panel, making them invaluable for researchers who need reliable respondents.

Are you ready to elevate your consumer research?

Try PickFu to get high-quality participants for your survey!

FAQs

Do you require a probability sample?

Probability sampling means everyone in the group you’re studying has an equal chance of being picked, which helps you make accurate conclusions about the whole group. It takes more work but is great for studies with lots of numbers.

Non-probability sampling is quicker and easier because you pick people based on convenience or judgment, but it can be biased. It’s good for exploring ideas or when you have limited time or money. Hence, the answer is ‘it depends’ on the focus of your study and its depth.

How to turn survey results into a great presentation?

Use clean and visually appealing graphs and charts to highlight key data points. Craft a compelling narrative to provide context and explain the significance of the numbers. You should also make clear, actionable recommendations based on your findings. You can use AI tools that automatically generate presentations based off data.