Does brand market research sound intimidating to you?

Collecting and analyzing marketing data can be hard and time-consuming for marketers and busy entrepreneurs. But the good news is that it doesn’t have to be that way.

In this post, you’ll learn about branding and why market research matters. You’ll also unlock the best research tool to inform your marketing strategy.

By the end of this post, you’ll take your first real steps to launch your own brand market research – which will help you build a unique brand identity that towers over the competition and wins over your audience.

What is brand market research?

Let’s start with branding.

You might think branding is how you present your business to potential customers.

Sure, it’s partially about your brand name, logo, colors, copy, and other collateral.

But when it comes down to it, your brand is whatever people think it is.

Your brand image is the impression your audience forms when they see your ad or read a comment on your social media profile. It’s also impacted by your competition’s marketing efforts and what’s happening in your industry.

You can try to influence your brand perception with ads and marketing campaigns. But is that enough?

There’s always the chance of a gap between what you showcase and what people think you are. This is where brand market research comes in to fill the gap or even avoid it entirely.

Brand market research involves gathering critical information about your audience, your current brand image, your competition, major trends in your industry, and anything else you need to feed your marketing strategy.

As you’ll see next, brand research will empower everything from product development to boosting your brand recognition.

Why is brand market research important?

Think of venturing into brand strategy as embarking on a wilderness journey. Just as you wouldn’t set off without a map, food, water, and a flashlight, you shouldn’t dive into brand strategy without essential tools like competitive analysis and target audience research.

Without the right information, your business decisions might lead you astray. Inconsistent messaging and poor positioning could leave your business vulnerable, much like a hiker lost in the woods.

Preparation is key to ensuring your brand’s survival and success.

Now let’s look at more benefits of conducting market research:

- Understand your target audience. When you do market research, you study your customers closely by understanding their demographics, pain points, interests, etc. You’ll draft better messages and get more engagement.

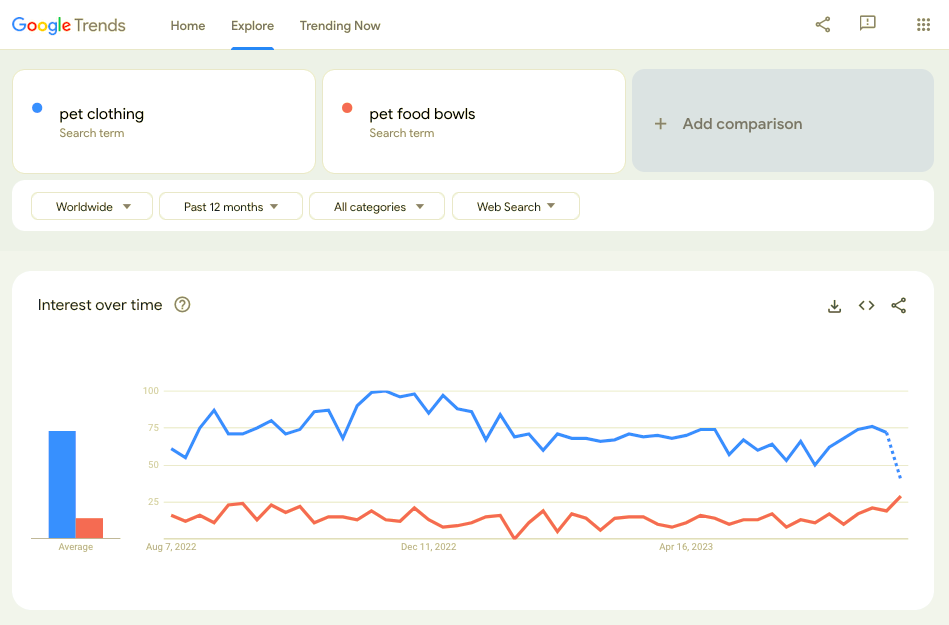

- Identify market trends. Keep a finger on the pulse of what’s happening in your industry. For example, you can find AI applications in every sphere. Are you adapting to industry changes and incorporating them into your brand image?

- Define your brand positioning. Find opportunities to stand out from your competition so that people remember you. Your research will help you develop a unique value proposition, so you’re not known as just X’s Alternative (where X is your competition).

- Understand your brand value. What is your company’s brand worth if you had to sell it today? Doing research helps you assign a monetary value to your products, business name, logo, and more. This allows you to understand how to price your offerings, market yourself, and figure out if your business is growing.

- Track your brand health. How strong is your brand image compared to the competition? Track brand health by taking stock of your reputation, doing keyword research, using Net Promotor Score (NPS) surveys or it’s alternatives, and tracking other key metrics.

- Build brand loyalty. Keep your customers coming back and actively choosing your business over your competition. Craft loyalty marketing campaigns, build brand awareness, and shape a customer-focused business.

The information you gather during your research will help you ultimately strengthen brand recognition among your audience. Now, let’s explore practical research steps.

6 tips for conducting brand market research

We’ll focus on primary research, where you collect information yourself from different sources. Secondary research from books, papers, and research platforms will also support your brand research, and we’ll cover them later.

When researching your brand, your main goal is to see how all the different parts of your brand kit come together to create the identity you want. Here are some of the elements you’ll validate with key research techniques:

- Your brand logo designs

- Typography

- Content and copy testing on CTAs, slogans, and taglines

- Product package designs

- Product features

- Color schemes and palettes

- Graphics, icons, and hero images

- Business names and more

We’ll show you how to get qualified feedback and data on these branding elements with the best tools. Let’s get started!

1. Define your market research goal

Refer to the previous section on what brand market research can do for you. You’ll want to set up a clear research goal to direct your efforts. Here’s a step-by-step process for doing this:

- Create an overarching goal or vision. For example, your big goal could be rebranding your business. This means you’ll do research related to creating a new brand identity to ensure that your rebrand doesn’t fail.

- Break down the goal into smaller objectives. If your broader goal is to boost customer satisfaction, you’ll investigate new product ideas, better UX/UI on your site, and so on.

- Make your objectives actionable by using the SMART framework. Make your goals specific, measurable, achievable, relevant, and time-bound. For example: increase sales on your Amazon store by 10% in 6 months with optimized product listings.

- Figure out your data needs. We have this covered in the following sections, so keep reading!

Clear research goals will keep you on track and help you collect data effectively. Let’s look at another key factor to cover before we take action.

2. Know your target audience

Effective brand market research begins with a deep understanding of your target customers. Uncovering the following information will impact business decisions, product development, and more:

- Demographics: Data on age, location, income, education, and other demographic factors.

- Customer traits and behaviors: Common traits and behaviors within each market segment or group, like social media usage, eating habits, and so on.

- Psychographics: Customers’ interests, values, lifestyle, and attitudes.

- Pain points: The challenges your customers face in your niche or industry.

There are many ways to get this information. Here are some methods for collecting consumer insights you can do right away:

- Analyze your website data using tools like Google Analytics to learn where your site visitors are from and how they find you.

- Talk to your sales and customer-facing teams for information.

- Listen to social media conversations, reviews, and customer feedback.

- Analyze email marketing campaigns to track open rates, click-through rates, and engagement with different content.

- Collect information from your audience via polls, surveys, feedback forms, and focus groups.

Gathering information via polls and online surveys can be a daunting task. Fortunately, we have the best solution for carrying out such primary research, with leads us to our next tip…

3. Run polls with PickFu

Polls are an essential part of your research methodology toolkit.

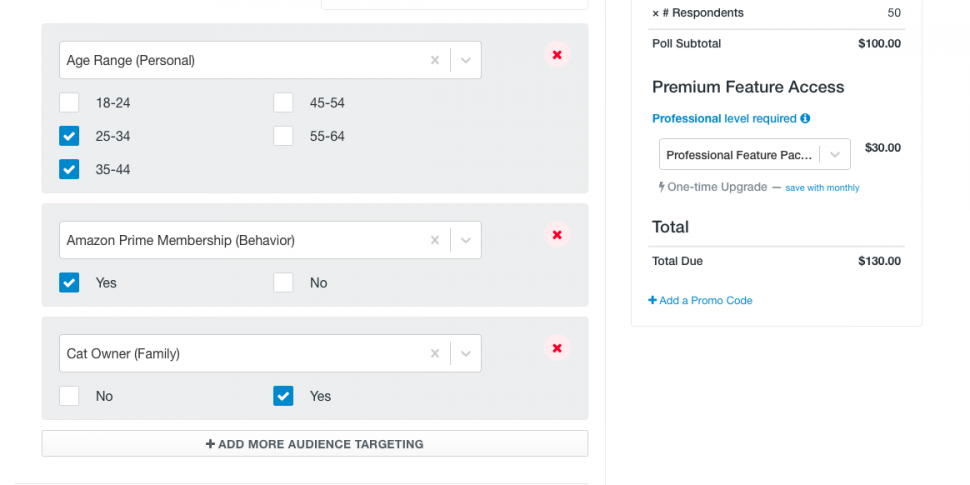

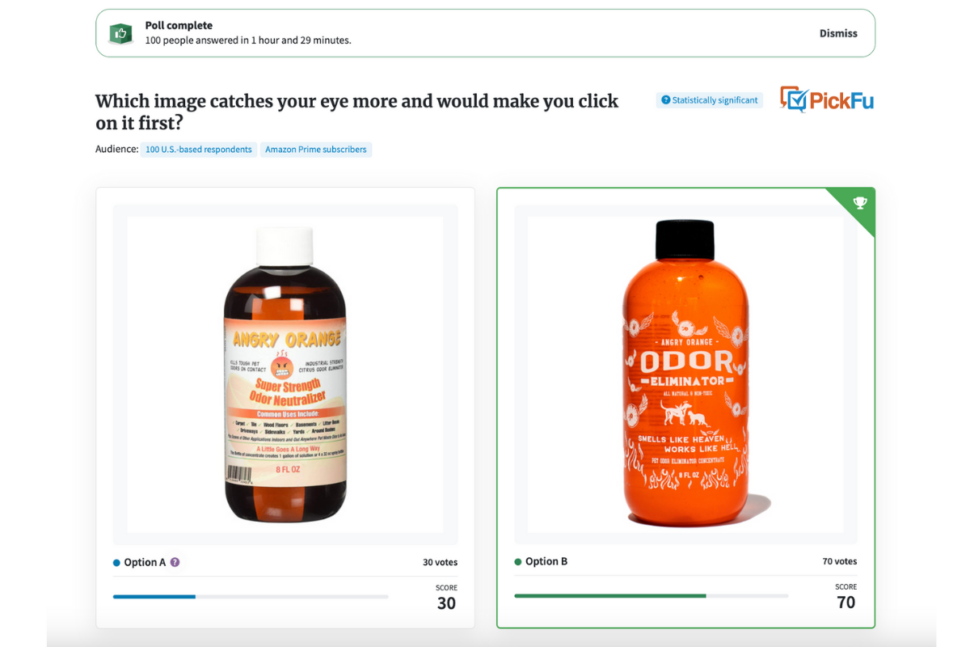

At PickFu, we help you run polls at lightning speed to gather data from 15 million respondents representing 90+ target market traits.

Here are the different types of polls we empower you to run:

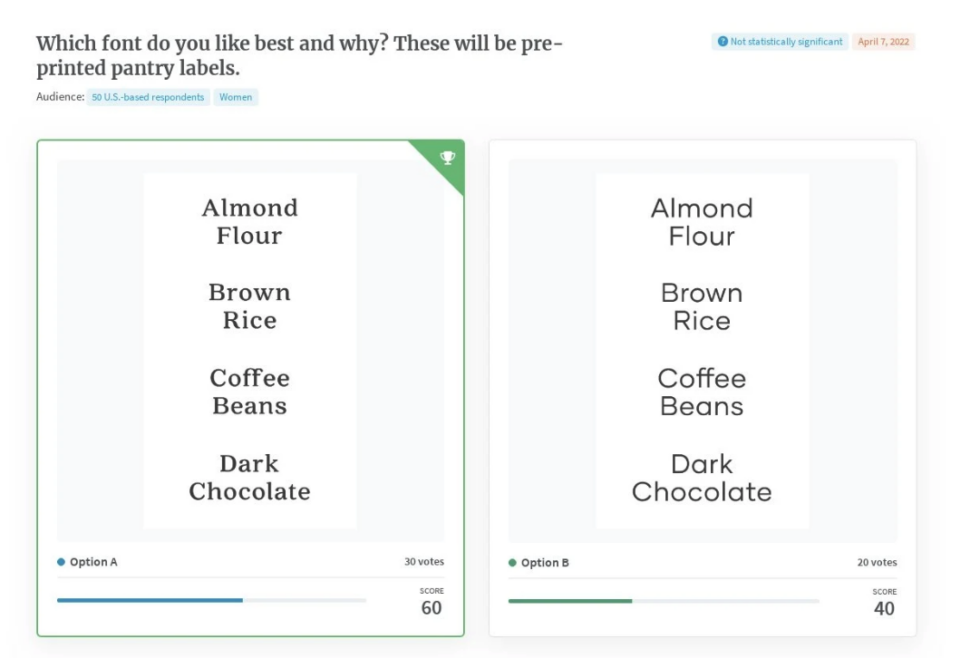

Head-To-Head polls

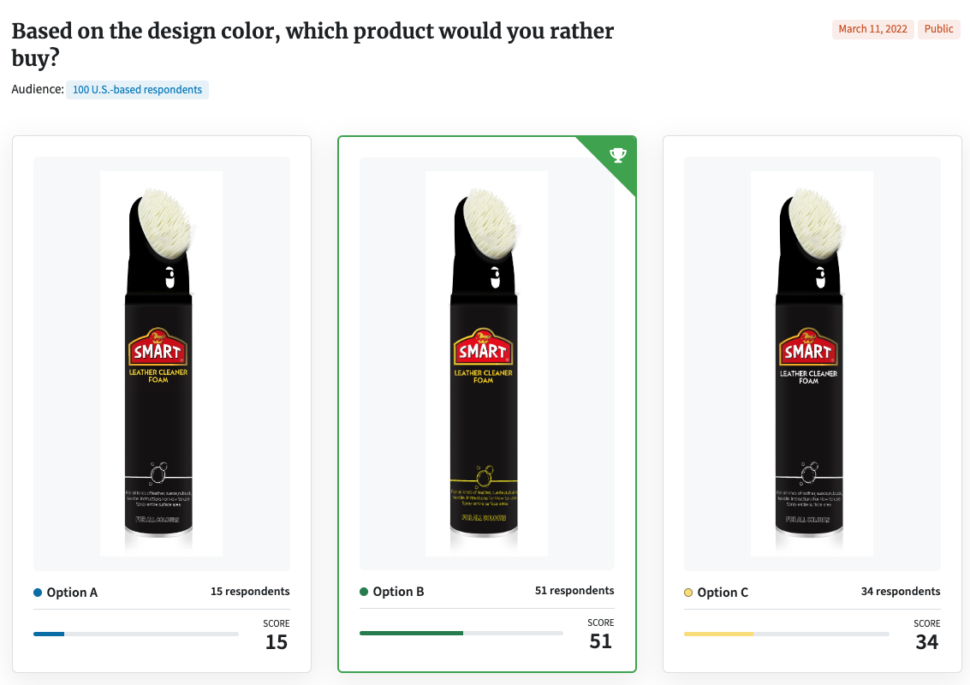

Use Head-to-Head polls for a face-off between logo designs, packaging designs, names, or any element of your brand.

A Head-to-Head poll is similar to A/B testing, but with PickFu, you get immediate results and clear reasons for your audience’s choices. See how Thrasio used these polls to enhance its packaging design, resulting in a 10x revenue increase to over $23 million.

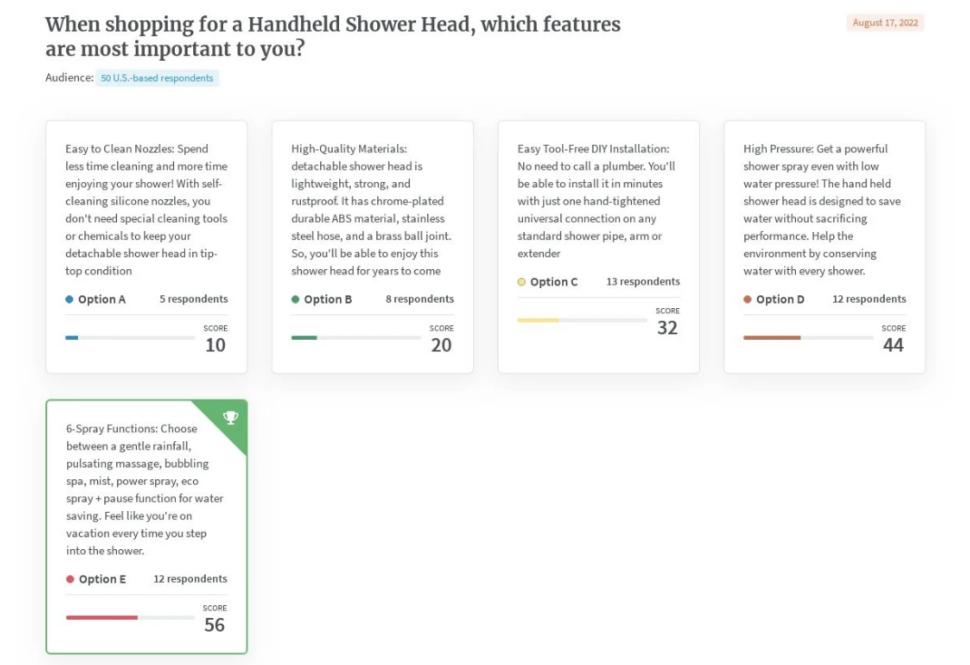

Ranked polls

Discover your audience’s preferences with Ranked polls. Get relevant participants to rank your product designs, features, and more based on which option they like best. You’ll also receive valuable comments with in-depth explanations about audience preferences.

Beetroot Lab’s use of these polls contributed to over 1 million downloads and a 4.8-star rating for their game.

Open-Ended polls

Harness raw, unfiltered feedback for refining your brand strategy. Test your logo, images, text, and videos, or ask a question to receive high-quality responses. This feedback is great for doing brand recognition research and building an impactful branding strategy.

For example, you could ask, “What’s the most frustrating problem you encounter when shopping online for clothes?” An open-ended poll like this will reveal ideas you’d never think about on your own.

Run polls with PickFu, and never leave your branding decisions to guesswork. It’s also a powerful Amazon seller tool for optimizing product listings. You can also use it for Google shopping optimization to convert more when you run product ads.

So, get on board and kickstart your market research now!

4. Conduct surveys

Like polls, surveys are a great way to gather primary research.

However, while polls are often quick and to the point, conducting surveys can be longer and more detailed. They’re also generalized to apply the data to a larger population. Knowing how to conduct a survey properly is an important concept.

Surveys allow you to gather quantitative data from your target audience by asking them a series of questions. You gain insights into their preferences, interests, and needs related to your brand.

Surveys are often expensive and time-consuming to conduct. A faster, more cost-effective option is to use PickFu polls to collect meaningful data from targeted respondents.

5. Run online focus groups

Focus groups are a research method where an in-person group represents your target audience and discusses your brand elements. This type of research happens live, and while you can get in-depth and valuable feedback, it’s often costly and time-consuming to organize.

But there’s a more convenient way to achieve similar results. PickFu eliminates the need for physical venues and allows participants to give feedback from home. This often results in more transparent, high-quality responses.

Here’s a simple example of an online focus group in action: our client asked users which app icon is best for an RPG mobile game. Not only was there a clear winner, but our client also learned why participants preferred a specific icon.

6. Carry out other types of market research

So far, we’ve looked at primary research, which is research you collect independently. Let’s look at secondary research, where you use existing data. This is also known as desktop research.

Here are a few helpful secondary research methods:

- Market research reports. You can buy reports from research firms for insights on market trends, customer behaviors, and competitor analysis in your niche.

- Social media listening. Monitor brand mentions and relevant discussions on social media for customer feedback and insights. Tools like Hootsuite and Mention can help.

- Third-party agencies. You can hire market research firms for secondary research. They often have extensive data and can provide tailored reports.

- Online databases and journals. Use resources like JSTOR, Statista, and industry databases for secondary research.

- Keyword research. Use SEO tools like Ahrefs and Semrush to find long-tail keywords, content gaps, and other insights into your brand and competitors’ online activities.

There you go – we’ve covered several key steps in gathering market intelligence so you can shape how your brand stands against the competition.

Conclusion

The greatest businesses in the world have a powerful brand identity.

From the golden arches of McDonald’s to the iconic swoosh of Nike, branding helps businesses establish a strong presence in the market.

A powerful step you can take toward building a great brand is to accelerate your research with PickFu. We’ve made it easier than ever for marketers, business owners, and more to gather valuable insights from real people.

Sign up with PickFu and start making data-driven branding decisions today!

FAQs

Who is normally responsible for market research in a company?

A marketing leader, a business owner (in the case of a small business), or a research firm outside the company is usually responsible for conducting market research.

Typically, marketing personnel with in-depth insights into the company’s offering need to do marketing research. They can bridge the gap between customer demands and business offerings, resulting in better brand positioning.

What is the difference between qualitative and quantitative research?

Qualitative research involves gathering data through interviews, focus groups, case studies, and other techniques that provide more open-ended and exploratory feedback. This type of research is often used to support brand perception studies and gain insight into consumer behavior.

Quantitative research collects numerical data from surveys, polls, and experiments. This type of research is more structured than qualitative research but still provides valuable customer insights.