Fulfillment by Amazon (FBA) has opened new doors for Amazon sellers who otherwise wouldn’t be able to store and ship their own products. But lately, the surge of interest and activity around FBA is coming from a different source: Amazon FBA acquirers, aka roll-ups or aggregators.

These are companies that buy FBA businesses and fix them up for a profit. It’s the e-commerce equivalent of flipping a house — and it’s a hot market. In the last few years, big-ticket Amazon aggregators like Thrasio, Heyday, Cap Hill Brands, and Perch have received billions of dollars in financing from institutional investors to grow their portfolio of FBA businesses.

If you’re want to understand how Amazon aggregators work and who the major (and emerging) players are, you’re in the right place.

Let’s start with a look at how the Amazon FBA program works.

Table of contents

- How does Fulfillment by Amazon work?

- How much does the average FBA seller make in a year?

- How many people actually succeed in Amazon FBA selling?

- How does an Amazon roll-up work?

- What does an Amazon aggregator look for in a business?

- How sustainable is the FBA roll-up strategy?

- How do Amazon roll-ups use PickFu to grow their brands?

- Split test every creative asset before launch

- Top Amazon aggregators and their funding

- Frequently asked questions

How does Fulfillment by Amazon work?

With Amazon FBA, sellers send their products to an Amazon fulfillment center for storage. When a customer buys their product, Amazon takes care of packaging, shipping, and delivery.

Because Amazon roll-ups acquire and manage multiple FBA sellers, the economies of scale make it cheaper per business than running it alone. Still, this doesn’t explain how these FBA aggregators turn around floundering businesses to make them profitable. That involves sales expertise, hard data, and, in Thrasio’s case, using PickFu to optimize decisions.

We’ll get to that. Next, let’s talk about what it’s really like for an Amazon FBA seller.

How much does the average FBA seller make in a year?

No one knows for sure how much the average FBA seller makes, but a JungleScout report published in January 2021 found that the average annual income for a new Amazon seller — that is, someone who’s been selling for less than two years — is around $42,000.

Most Amazon sellers (70%) make a profit of at least $1,000 a month, according to JungleScout.

Even more telling, especially in the context of FBA acquirers, is total lifetime profit. If you’re considering selling your FBA business to a roll-up company, you want to make sure you’re getting your money’s worth. The majority of Amazon sellers (57%) never breach $100,000 in lifetime sales, which helps explain the appeal of selling to a roll-up.

How many people actually succeed in Amazon FBA selling?

Amazon is hands-down the most competitive e-commerce market out there. Sure, online shopping is as popular as it has ever been, but that only brings in more competition. Even experienced Amazon sellers are finding it difficult to compete with younger brands who have bigger budgets.

Success on Amazon, with or without using FBA, depends on a few different criteria.

First and foremost are your products. Unique and hard-to-find items do well on Amazon because there’s less competition. Once you figure out your product sourcing, you then have to think about shipping and logistics, which is why sellers turn to FBA in the first place.

Price is also critical. If you’re selling the same products as other merchants, whoever has the lowest price often gets the sale. This puts even more pressure on sellers to lower their markups and find viable shipping alternatives.

Last, you need to understand digital advertising and e-commerce marketing, especially on Amazon itself. Paid product searches and winning the Buy Box can make or break your success, but there’s a certain skill to it that only comes with practice.

How does an Amazon roll-up work?

An Amazon roll-up buys up smaller Amazon businesses and operates them under one roof, using its expertise and resources to scale them into profitable brands.

That expertise is key, and it’s abundant among the people who’ve launched and run FBA roll-ups. Many are intimately familiar with the e-commerce and retail industries, having been sellers, operators, and CEOs themselves.

Roll-ups run on funding (and plenty of it) from private equity investors and venture capital firms. Why all the interest from investors? Simply put, there’s a lot of money being made on Amazon — more than half of U.S. consumers go to Amazon first when they start an online shopping search — and there’s a lot more money to be made via the roll-up model.

What does an Amazon aggregator look for in a business?

Every rollup has its own approach and criteria. Some have an interest in certain product categories. Others look for brands that fall within a specific revenue range.

Here are some of the factors an Amazon aggregator considers when looking to roll up smaller businesses:

- Positive reviews

- Product quality

- Steady demand

- Long-term growth potential

Generally speaking, a business that’s in good standing with Amazon — with a deep well of good reviews, a strong customer base, and a consistently competitive search rank, among other things — is highly attractive to Amazon aggregators. A seller that uses so-called black hat tactics to boost their ranking is not.

Just about every seller has watched Thrasio, the giant among FBA roll-ups, acquire and grow businesses at a rate unmatched in e-commerce. So what does Thrasio look for in an FBA business?

The company is interested in brands with between $1-100 million in revenue. Ideally, these brands sell private-label, everyday goods with strong demand and consistent search volume.

Thrasio has no interest in tech goods, food or grocery products, or anything tied to the latest fads and fashions. It looks for longevity and potential in the businesses it acquires.

How sustainable is the FBA roll-up strategy?

Much of the recent activity around FBA acquirers stems from the increase in online shopping in 2020 during the COVID-19 pandemic, although the spike is gradually subsiding.

Still, Amazon is more popular than ever, and there are plenty of young brands with great products that could benefit from a structural makeover.

The biggest threat to the aggregator strategy lies in oversaturation. The more roll-up companies invest in Amazon marketing and advertising, the more those costs go up. First, they’ll outprice the mom-and-pop sellers. Eventually, they’ll bankrupt each other.

That scenario is still far off from the current environment, and who’s to say Amazon won’t alter its advertising policies before it becomes a problem. The more pressing and urgent questions facing Amazon FBA acquirers are the same for any roll-up: can you turn around your acquisitions in time? And is Amazon FBA worth it?

For some, the answer lies in PickFu.

How do Amazon roll-ups use PickFu to grow their brands?

Thrasio is the largest Amazon FBA acquirer, with $1.7 billion in investments. The company takes a data-driven approach to rollups. Poke around its website and you’ll see how it puts its funding to good use through data analytics, logistical planning, and user testing.

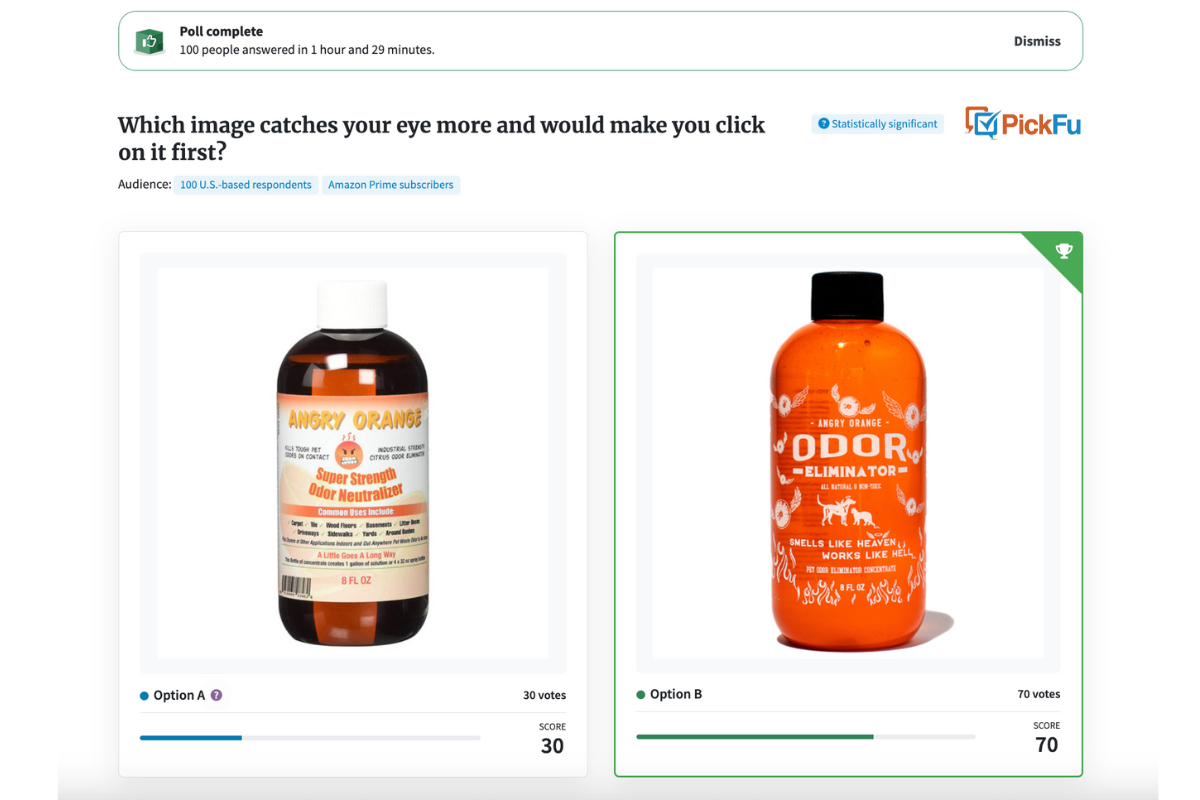

Take Thrasio’s rebranding of Angry Orange, a pet odor-eliminating spray. It’s a quality product, but the original packaging design was unimpressive.

“Amazon is an exceptionally visual medium,” said John Hefter, Thrasio’s senior vice president of creative and brand strategy. “We buy with our eyes first. When you scroll down the page, what makes your eye stop? Where does your mouse cursor just stop?”

Like all Amazon sellers, Hefter wanted concrete answers to these questions.

After acquiring Angry Orange, Hefter’s team at Thrasio tested new product designs using PickFu. They ran a series of polls asking 800 consumers for feedback on bottle variants. The results helped them understand what people liked and didn’t like about the new orange color and bottle design so they could optimize the packaging accordingly.

Thrasio even created a new spray-on Angry Orange product, thanks to feedback from PickFu’s respondent panel.

When Thrasio launched the new product images on Amazon, the data from the PickFu polls rang true. Almost overnight, the unit session rate for Angry Orange increased from 35% to 42%, and the average units sold per day increased to a high of 160.

All in all, sales of Angry Orange are up 912% compared to before the acquisition.

Split test every creative asset before launch

Thrasio continues to use PickFu to optimize product images and product descriptions. That’s the beauty of split testing — you can evaluate almost any decision, including screen layouts, call-to-action text, and even product names.

Other top-funded FBA acquirers who use PickFu’s instant polling platform include Elevate Brands, Berlin Brands Group, and Boosted Commerce.

If you’re going to invest in acquiring an Amazon FBA business, you need to ensure you’re making the right decisions to turn it around. With PickFu, you can gather quantitative data from your target customers to confirm that your rollup is headed in the right direction.

Top Amazon aggregators and their funding

Now you have an idea of what Amazon roll-ups do. So who’s who in the market? We’ve listed them alphabetically below with their current funding, if known or disclosed.

- Accel Club ($169.8 million). Amsterdam-based startup focuses on the global expansion of independent brands.

- Acquco ($160 million). NYC-based founders are Cornell University grads.

- aim.group. Belgian company specializing in acquisition of family businesses.

- Alpha Rock Capital ($138k). Started in 2017, based in Delaware.

- Amazing Brands Group (undisclosed). Tech-driven team based in Cologne, Germany.

- Aterian, formerly Mohawk Group. Tech-enabled NYC-based firm with 12 brands and six offices worldwide. Founded in 2014.

- Benitago Group ($55 million). Founders were Dartmouth College classmates who started by selling a back pillow on Amazon.

- Berlin Brands Group ($542 million*). Founded in 2005, one of Germany’s top digital companies with 14 direct-to-consumer brands across 28 countries.

- Boopos. Based in Madrid, Spain, offers a revenue-based financing model for sellers.

- Boosted Commerce ($137 million). L.A-based acquirer of Amazon and Shopify brands and private-label FBA businesses.

- Branded ($150 million). Generated $150 million in gross revenue since launching in 2020 in Paris.

- Cap Hill Brands ($150 million). Seattle consumer products firm founded in 2020 by two former Zulily executives.

- Centro Brands. Based in Austin, Texas. Team includes former Amazon execs.

- D1 Brands ($123 million). NYC-based firm launched in 2020.

- Diverge Group. U.K.-based company focused on UK-based consumer businesses.

- Dragonfly ($29 million). Founded in 2019, headquartered in Boston.

- Dwarfs.io ($9 million). Dutch firm with an interest in European marketplace brands selling outdoor, home improvement, sports, household, and pet goods.

- eBrands. Finland-based acquirer of small- and medium-sized Amazon brands.

- Elevate Brands, formerly Recom Brands ($317 million). Founded in 2016, the NYC-based company notched an additional $250 million in July 2021.

- EnCap33. Ohio private equity firm specializing in merging e-commerce brands.

- Excite Foundry. U.K.-based digital brands aggregator.

- factory14 ($200 million). Luxembourg-based startup acquires smaller successful niche brands.

- Forum Brands ($127 million). Data-driven, NYC-based acquirer of consumer brands selling everyday products.

- Foundry ($100 million). Launched in 2021 in Austin, Texas by a team of former Amazon execs and operators; CEO Helen Vaid led Pizza Hut’s e-commerce platform to global expansion

- Flummox. Based in Switzerland with a focus on Amazon FBA and Shopify brands.

- Flywheel Commerce. NYC-based firm targets sellers with $1-5 million annual revenue.

- GlobalBees ($150 million). India’s largest roll-up partners with brands in the $1-20 million revenue range across beauty, food, home, lifestyle, nutrition, and sports segments.

- G.O.A.T. Brand Labs ($36 million). India-based startup focuses on early-stage brands in the beauty and lifestyle segments.

- GOJA (undisclosed). Launched in 2009 in Miami, it grew from e-commerce retailer to software developer.

- Gravitiq ($55 million). With its doctor-led leadership team, this London startup focuses on healthcare-related Amazon brands.

- Greenhaus. NYC-based firm opened in 2020.

- Growve ($175 million). Founded in 2018, Florida-based company specializes in acquiring health, wellness, and beauty brands.

- Heroes ($265 million). London-based firm with a focus on high-performing brands, led by brothers Alessio and Riccardo Bruni.

- Heyday ($250 million). San Francisco-based company launched in August 2020 and raised $175 million in Series A funding 3 months later.

- Inflection Brands. Acquisition firm based in Raleigh, N.C. that prioritizes business experience.

- Intrinsic ($115 million). NYC firm launched in March 2021, acquires health and wellness brands selling on Amazon.

- Mantaro Capital. Vancouver-based company with down-to-earth values.

- Marketplace PowerBrands. German company launched in 2020 and operates in Planegg.

- Mensa Brands ($50 million). Investment startup, launched in 2021, buys and scales digital brands across India.

- Merama ($445 million). Mexico City platform launched in late 2020 with a focus on select Latin American e-commerce brands.

- Merx. Stuggart, Germany firm has a strong foothold in European e-commerce.

- Moonshot Brands. Oakland, Calif. company founded by Shark Tank/Dragon’s Den contestants, Allan Fisch and CJ Isakow.

- Nebula Brands ($106 million). China’s first Amazon aggregator with an international brand focus.

- Next Century Capital. Fast-growing U.S.-based firm.

- Olsam Group ($165.3 million). U.K.-based company led by brothers Ollie and Sam Horbye.

- One Retail Group. Founded in 2013, London-based multinational company has diverse portfolio of lifestyle and consumer goods brands.

- Opontia ($20 million). Dubai firm launched in 2021 to roll up small e-commerce businesses in African and the Middle East.

- Orange Brands. German acquisition firm specializing in European microbrands.

- Perch ($908.8 million). Boston company with a focus on technology as a means of sales optimization.

- Profound Commerce ($53 million). Founded in 2019 with offices in Austin, Texas and Cebu City, Philippines.

- Rainforest ($56.5 million). Singapore-based firm interested in the brand longevity of Asia-Pacific Amazon marketplace sellers.

- Razor Group ($1.1 billion). Berlin-based “consolidator of consolidators” leveraging over a decade of e-commerce experience.

- RubiBrands ($23 million). Turkey’s first FBA aggregator with a focus on e-commerce brands in Central Eastern Europe, Middle East, and Africa.

- Savitar. Based in Madrid.

- Scythia. U.K.-based firm focused on private-label brands in the U.K., Europe, and U.S.

- SellerX ($265.9 million). Berlin-based startup founded by Harvard Business School alums Malte Horeyseck and Philipp Triebel.

- Society Brands ($204 million). Headquartered in Canton, Ohio, this firm takes a “founder-friendly” approach to acquisition and growth.

- Sorfeo. Launched in 2020 out of McLean, Va.

- Stryze Group ($100 million). Berlin-based company started in late 2020, acquires existing brands and develops its own.

- Suma Brands ($150 million). Minneapolis startup founded by team that includes Blue Apron founder Matt Salzberg.

- Tapuya Brands. NYC-based firm launched in 2021.

- TCM Digital ($28 million). Israeli company buys and scales in all marketplaces, from Amazon to Walmart.

- Telos Brands ($2.1 million). Technology-first San Francisco aggregator targets category leaders.

- 10club ($40 million). Fast-growing Indian startup with a Thrasio-like model focuses on small brands.

- The Fortia Group. Dublin-based group focused on European e-commerce.

- The Mothership. U.K. startup founded in 2021 by four tech and product entrepreneurs.

- Thrasio ($3.4 billion). Founded in 2018, this American company leads the pack in funding. Headquartered in Walpole, Mass.

- UmbrellaFund. Based in Texas, launched in 2019, experienced in digital marketing and e-commerce.

- Una Brands ($115 million). Founded in May 2021, this Singapore firm focuses on multiple e-commerce platforms across the Asia-Pacific region.

- Unybrands ($325 million). Global firm with headquarters in Miami, founded in 2020.

- Valoreo ($80 million). Fast-growing Mexico City-based acquirer with a focus on Latin American brands.

- Win Brands Group ($50 million). NYC-based firm launched in 2017. Interest in customer-focused DTC brands.

- Wonder Brands ($20 million). Mexico City startup focuses on Latin American e-commerce brands in the beauty, fitness, and home and garden sectors.

- YABA. ($144.7 million). Barcelona company founded in 2020, seeks category-leading FBA brands.

* includes allocations from their own balance sheet

Frequently asked questions

There are more than 6 million third-party sellers across Amazon, of which 1.6 million are considered “active” sellers, according to Marketplace Pulse. In the first half of 2021, 363,000 sellers joined Amazon. That’s roughly 2,041 new sellers every day.

The top Amazon third-party seller worldwide is MEDIMOPS, a German retailer of games, DVDs, CDs, books, and other media. That’s according to Web Retailer latest rankings looking at data through June 2021.

You can’t. Your Amazon seller account is unique to you and your business. In Amazon’s own words, “If the ownership of a business changes for any reason, the new owner needs to establish a new seller account.” You can add or change the users who manage your account. You can close your account. You can sell your Amazon business to a roll-up company. But you can’t simply sell or transfer your seller account to someone else.

Whether you have five or 500 items to sell, you can become an Amazon third-party seller. But given that Amazon is the world’s largest online marketplace, it should come as no surprise that the company has a host of criteria and policies you must abide by once you register as a seller, starting with the Amazon Seller Code of Conduct.

An aggregator pulls together information or materials from multiple sources into one place. In the e-commerce ecosystem, an aggregator is a company that buys and operates a bunch of smaller third-party brands and sellers.

Aggregators on Amazon focus on consolidating small and medium-sized FBA and Amazon-native brands under one roof. Amazon aggregators look for brands that show long-term growth potential and have a track record of selling high-quality products. With their sizable resources and expertise in supply chain management, technology, marketing, and sales, aggregators can more efficiently manage and grow the businesses they acquire. That’s their promise, anyway.

In e-commerce, an aggregator is a company or group of investors that acquires and runs multiple brands. An affiliate is a person who partners with a brand to help promote its products and services. Affiliates earn commission for the sales they help generate. These types of partnerships can be beneficial — and lucrative — for the individual and the brand.

An Amazon aggregation division is a division within a company that’s dedicated to researching and going after Amazon FBA brands to add to its portfolio. Grove Inc., a manufacturer of CBD and plant-based wellness products, is one example of a company with an Amazon aggregation division. Grove launched its aggregation division, Upexi, in October 2021 with a goal of acquiring at least 20 e-commerce businesses in the health, wellness, beauty, and pet care industries within two years.

The short answer? It depends. Just as every seller is unique, so is every aggregator as far as how much it’ll pay to acquire an Amazon FBA business. In a 2021 survey of Amazon aggregators by the Fortia Group, 47% said they paid on average between $2 and $5 million for a single brand. Generally, aggregators are attracted to private-label brands with growth potential that have a loyal customer base and fewer SKUs but higher revenues.

Whether you’re buying or selling an Amazon FBA business, you need to figure out its value. Most valuations are calculated using one of two methods: seller’s discretionary earnings (SDE), or earnings before interest, taxation, depreciation, and amortization (EBITDA). The more common SDE method deducts operating expenses and the cost of goods sold from gross revenue. Bigger businesses with more complex financials — those making $10 million or more — typically use EBITDA to figure out how much their business is worth.

Amazon’s sheer size and popularity among consumers means more opportunities for third-party sellers and the aggregators who are looking to snap them up. Fulfillment by Amazon has lowered the barrier of entry for sellers, making it easier for them to launch their businesses and actually be successful. In fact, 64% of Amazon sellers make a profit within their first year, according to JungleScout data. That’s exactly what aggregators like to hear.

With so many aggregators on the scene competing against each other to buy up promising third-party sellers, it’s easy to overlook the fact that this Amazon FBA roll-up trend is a new phenomenon. Some in the industry say the bubble is destined to burst as supply chain issues remain a big hurdle. Top-funded Thrasio, the unicorn among aggregators, was founded only a few years ago, in 2018. For so many others, it remains to be seen whether they’re equipped to deliver on their promise of turning a profit for the brands they acquire.