PickFu.com is where I go when I want to quickly split test Amazon product images to actual Amazon Prime customers, and know which images customers prefer, before I make my product listing live. I get results within 1 hour with detailed 'reasons why' they voted a certain way. This has the potential to save thousands of dollars in lost sales from choosing the wrong image.

Start making data-driven decisions

How e-commerce sellers like you use PickFu

Choose the best main image

Find the best main image for your product listings

Poll Question:

Which image do you prefer for [this product]?

Optimize your product title

Increase conversions on search results by prioritizing what's important

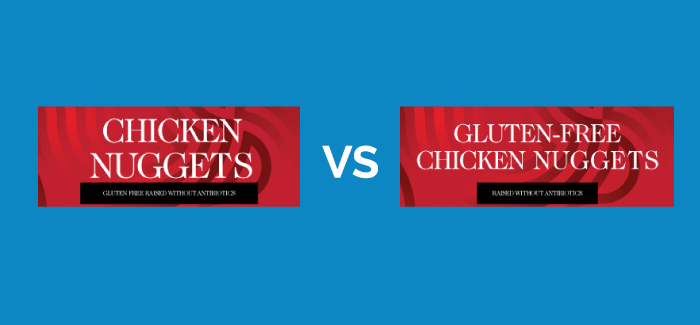

Poll Question:

Which product title would you be more likely to click on?

Test how your listing performs on a search results page

Understand your strengths and weaknesses against competing brands

Poll Question:

Which of these [product description] would you be more likely to click on, and why?

Choose product variations

Know what sells before you sell it

Poll Question:

Which ones are your favorites and why?

Identify areas for improvement

Find ideas to improve how your product is presented

Poll Question:

After reviewing this listing, what questions do you have about [this product]?

Identify gaps between you and the competition

Find ideas to improve how your product is presented

Poll Question:

After reviewing this listing, what questions do you have about [this product]?

Run pricing surveys

See how much customers would pay for your product

Poll Question:

How much would you pay for this?

Improve your product description

Increase listing conversions with compelling copy.

Poll Question:

Based on the description, which product would you rather buy?

Ask a pointed question about your existing creative

Poll Question:

How clearly does this image convey the idea that this product [does this function]?

Evaluate product videos

Poll Question:

After watching this video, how [luxurious, effective, or another product attribute] do you think this product is?

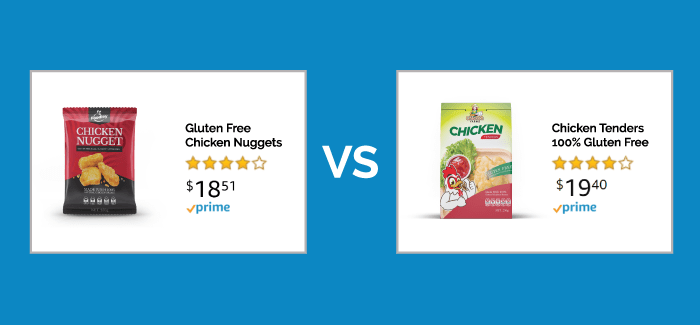

Test how your product performs against others

Poll Question:

Based on the image, which product which you rather buy?

Stack your product up against the competition

Poll Question:

Based on the title, which product would you rather buy?

PickFu vs. what you're doing now

| Asking friends and family | Buying expensive ads | Going with your gut | Using PickFu | |

|---|---|---|---|---|

| Definitive, quantitative result | ||||

| Qualitative, actionable feedback | ||||

| Fast turnaround | ||||

| Unbiased and anonymous responses | ||||

| Large representative audience |

Reliable, ready-to-go respondents

that represent the customer segments you value1-minute setup

Write one question and provide 1-8 options, and your poll starts collecting responses immediately

U.S.-based, unbiased respondents

Bring fresh eyes to your e-commerce product from people who are eager to help

Results in minutes, not days

Keep your momentum going with feedback you can use right away

Target customer segments

Test with groups of Amazon Prime members, pet lovers, frequent exercisers, homeowners, and other behavioral and psychographic segments

Useful written explanations

Learn the why behind each response to make better e-commerce product decisions

Demographic info

Slice and dice responses by age, gender, ethnicity, income, education, geography and other audience segments

Collect actionable data in minutes, not days

FAQ

Each set of results includes the following:

- Answer tally: Stats on how many people (and what percentage) chose each option.

- Answer comments: Each respondent explains why she chose what she did. These comments are often remarkably insightful. Many customers say it’s the most useful part of our service.

- Demographic info: Demographic data about those who answered your poll, including gender, age, race, income, and educational level - displayed on pretty charts and broken down by each answer.

You can test text, images or even video. Just make sure all your options are the same type of content. Read our about testing different types of content in our help center.

The PickFu Panel is comprised of U.S.-based, native English-speaking respondents that represent a wide swath of demographics. You'll find a diverse mix of ages, income levels, and education, as well as behavioral and psychographic traits including exercise frequency, reading habits, and mobile app usage.

No. Respondents do not see the final poll results. Respondents see a different view of the poll that includes your question, answer options, and any relevant segmentation survey questions. They do not see others’ answers or any identifying information.

We cannot pause or stop and restart a poll once it has begun to receive responses because if a poll question or its options were to be edited mid-way, the results would be unreliable. Please take advantage of the Preview function before publishing your poll. We do not issue refunds for typos and other user errors.

Yes, we randomize the order of the options. However, we keep the labeling consistent (i.e., "A" or "B"). This means that while the order of options will change (sometimes Option B will be presented before Option A), Option B will be called Option B in both instances. Here's an example poll to demonstrate.

Paid membership is an excellent option if (1) you poll regularly to improve your business or (2) you're an organization that would benefit from the advanced business-specific features (teams, co-branding, API access, etc) Read more about membership plans here.

No, polling costs are separate from plan costs. Your paid membership lowers the price per response for each poll using the PickFu Panel, and removes upgrade charges for premium polling features.